Buy-to-let (BTL) investors continue to benefit from falls in mortgage rates, and access to many more mortgage products. Could this be one of the reasons landlord confidence reaches a 5 year high?

A flurry of increased interest in buy to let as the choice of mortgage products for investors is now greater than at any time since 2007 according to independent finance service Moneyfacts. September 2021 started with 2,968 products on offer in the BTL sector, the highest number seen by Moneyfacts since October 2007. This is 71 products more than there were on offer pre-pandemic in March 2020 with two and 5 year fixed rate deals some of the lowest we have seen in a year.

Eleanor Williams of Moneyfacts says: “As we pass the 25th anniversary of the first BTL mortgages as we know them, our data gives landlords cause for positivity, as the number of products for them to choose from rose by 153, and at 2,968 is 1,162 higher than this time last year.

“As rental demand remains high, BTL could be a worthwhile investment and the rise in overall product choice and fall in average rates is positive.”

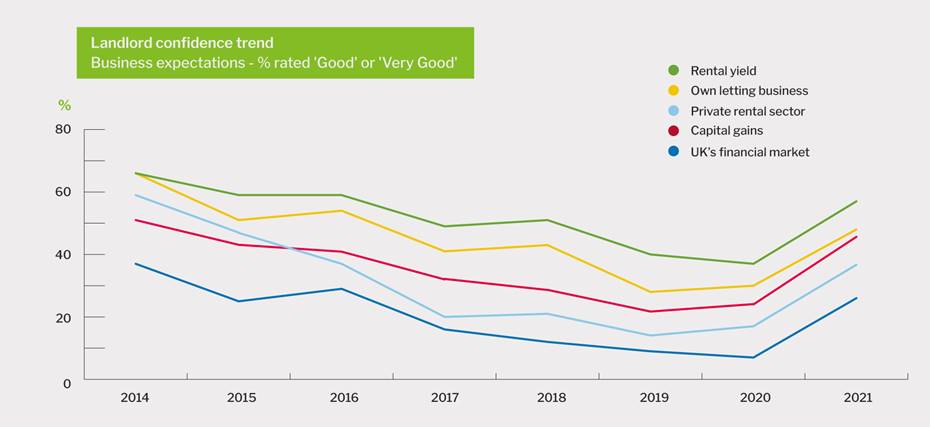

Along with this good news for BTL mortgages, Paragon bank has also recently conducted independent research amongst 600 landlords with regards to their confidence in the sector. They asked these landlords to rate their expectations for rental yields, their own lettings business, capital gains, the private rental sector, and the UK financial market.

The proportion who deemed the outlook for these measures to be either ‘good’ or ‘very good’ exceeded levels seen in Q3 2016, the survey taken just before the Brexit vote, with investor optimism consistently rising following the record low levels seen in Q1 2020.

The survey did highlight a link between optimism and portfolio size, with landlords managing larger portfolios tending to be more upbeat– 56% of landlords with eleven or more properties felt ‘good’ or ‘very good’, falling to 46% amongst those with between one and 10 properties. So, with more BTL mortgage products out there than ever before, rents increasing, demand from tenants still strong, the outlook is positive for UK landlords.

Angharad Trueman - Managing Director CGT Lettings Ltd

If you found this of interest, try my article on increasing your rental income HERE.